Hi, this is Evan Hutcheson, and today I wanted to briefly go over what auditors from the IRS are looking for primarily when they are auditing trucking companies. Of course, sometimes there are some glaring issues that cause the audit, in which case the auditor is going to specifically look at that issue. But in general, I'm going to go over just a few items that they usually take a look at. One of the biggest ones, and I'm talking about any trucking company, whether you're a private carrier or a common carrier or whatever, just a general freight carrier, one of the biggest issues is the employment tax issues. Now, here's an IRS link that kind of goes over whether or not someone is a contractor or an employee, and it gives some examples and rules and so forth. But anyways, this is just a lot of these drivers that are independent contractors, depending on what they do, might be liable for employment taxes. And they should be an employee, and the IRS is going to look at this. They're going to, the auditor is going to go in and make sure that these drivers should not be employees, and if they should be, they're going to file some back taxes on you for all the employment taxes that you should have paid in the past. They're also going to look at lumpers and swampers and different cargo handlers to make sure that they too should be contractors if they are filed as contractors. Now, this is, this isn't as big a priority for them as the drivers, but they will usually look at this too. And while we're talking about employment tax, so look at the supplemental wages that everyone's making and just make sure that the pensions, vacation pay, bonuses, they're...

Award-winning PDF software

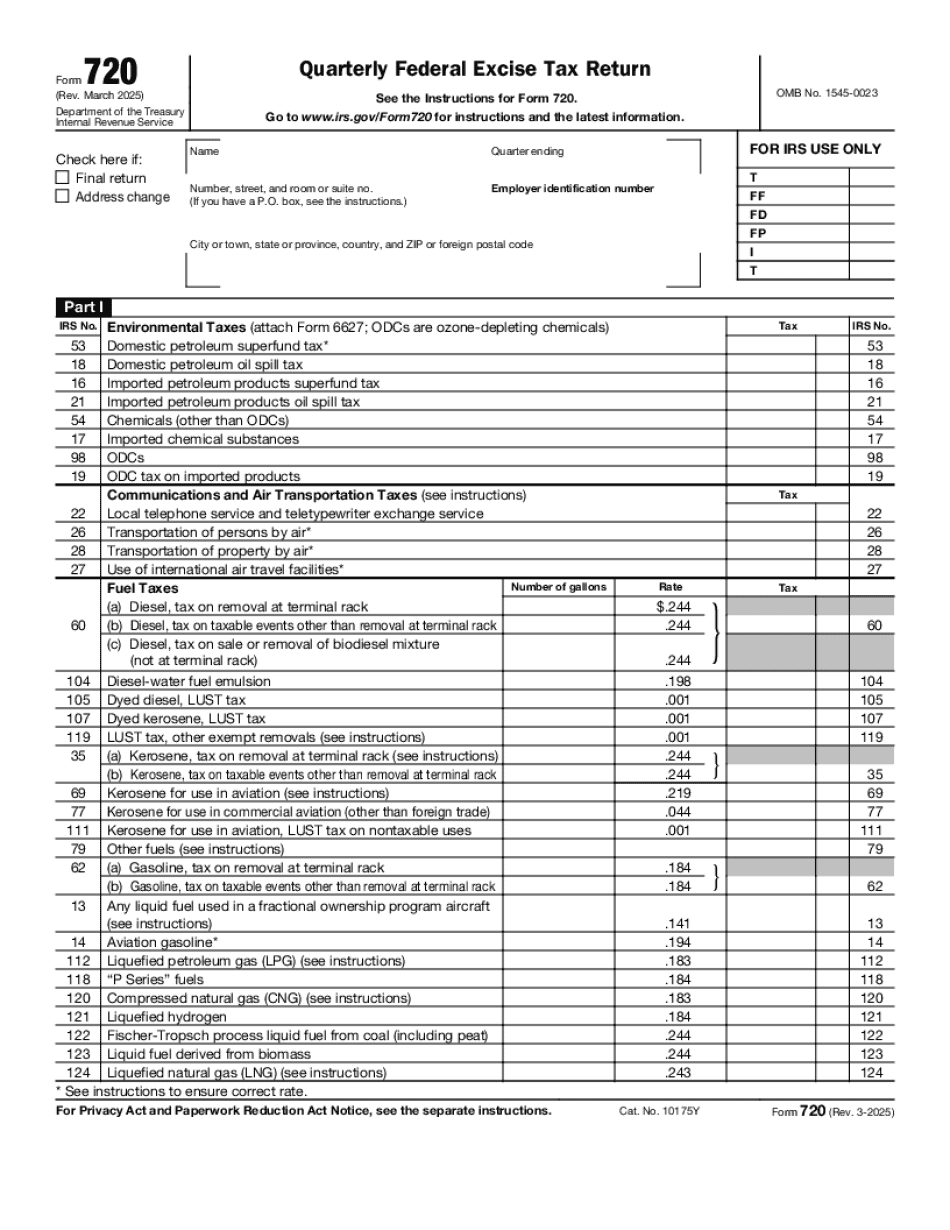

720 example Form: What You Should Know

Federal Excise Tax Bulletin, No. 10-20. What Is The Quarterly Federal Excise Tax Return? Department of Treasury. Office of the Tax Analysis and Enforcement Policy. “ Quarterly Federal Excise Tax Return: Federal Excise Tax, April 1 – March 31.” Office of the Tax Analysis and Enforcement Policy Bulletin. Online. No. 16-09. June 13, 2012. (link opens in new browser window) What Should Be Included On Form 720? The following information is a general overview of required items on Form 720 and any additional items, such as payment instructions. Form 720, Quarterly Federal Excise Tax Return, Federal Excise Tax Bulletin, No. 4-18. Department of the Treasury. Office of the Tax Analysis and Enforcement Policy. Federal Excise Tax Bulletin, No. 10-20. June 13, 2012. (link opens in new browser window) Form 720 (Rev. September 2022) is the quarterly Federal Excise Tax Return filed by a manufacturer, wholesaler, or dealer for the year ending on March 31.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 720, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 720 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 720 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 720 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 720 example