Hi, it's my plug head from Expat Wealth Advice. I'm going to answer the question, "Do I need to complete the Modelo 7:24 and if so, how does this work?" During this video, I'm going to look at two different scenarios. The first scenario is that you've never completed the Modelo 7:24 before. The second scenario is that you have completed it before and you're wondering whether you need to complete it again for the next tax year. Okay, so first we need to understand what the Modelo 7:24 is. It is an overseas asset declaration form. If you live in Spain and you are a Spanish tax resident, as the majority of UK expats living in Spain are, then you need to submit this form by the 31st of March each year if you meet certain criteria, which we will talk about. On the form, you need to declare the assets that you hold outside of Spain. Let's focus on the first scenario, where you have never completed the Modelo 7:24 before. The form breaks down your assets into three distinct categories: bank accounts, investments and life assurance, and annuities, and property. If you have more than 50,000 euros worth in any of these three categories, then you need to complete the Modelo 7:24 assuming you've never completed it before. Here are a couple of points to note. First, it may seem obvious, but some people get this wrong. When you make the declarations, you have to value all of your assets in euros. So, if your overseas assets are in a different currency, like the British pound, you have to convert it to euros using the exchange rate on the 31st of December for the year in which you're making the declaration. For example, if you're declaring for the year 2016,...

Award-winning PDF software

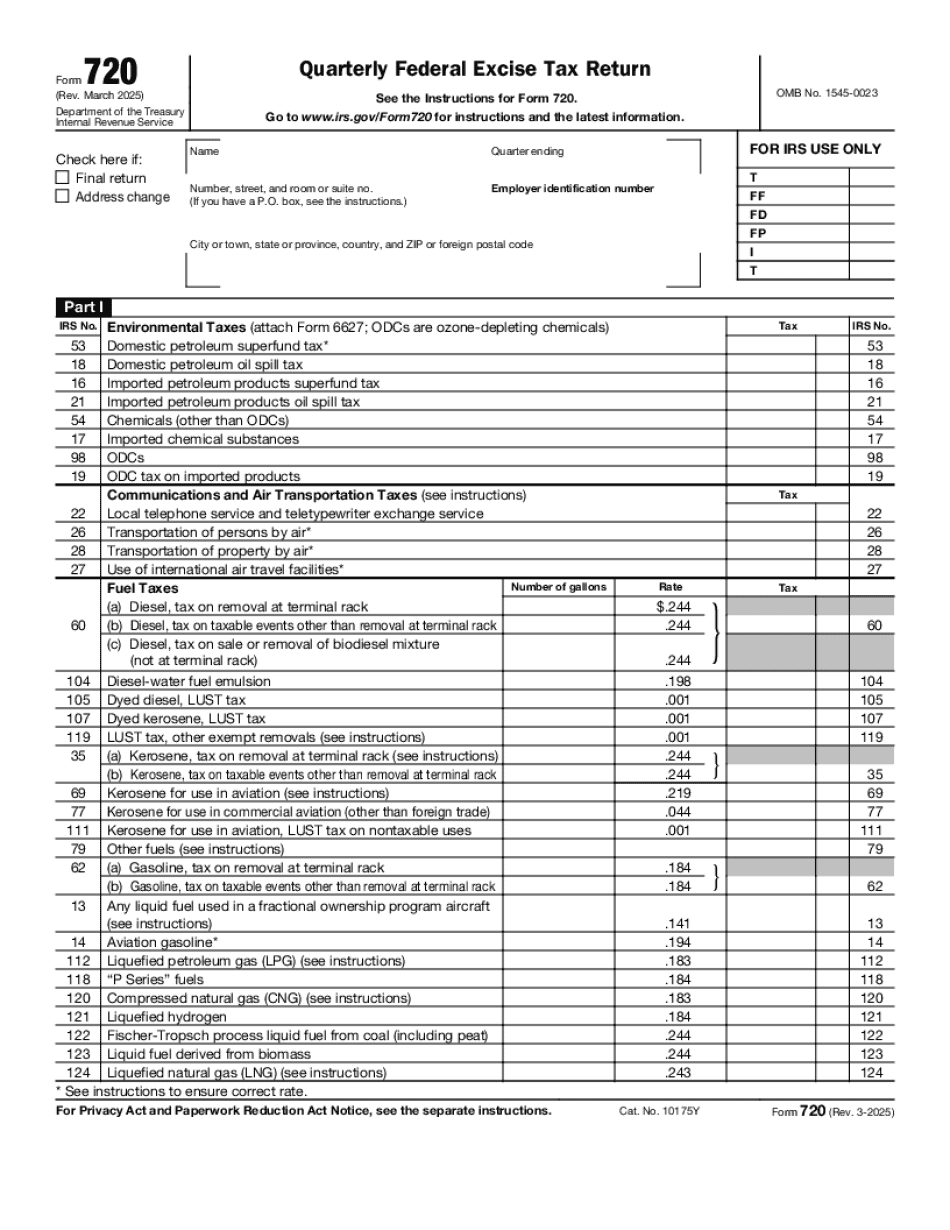

720 2025 Form: What You Should Know

This is an updated version of the IRS Form 720 Quarterly Federal Excise Tax Return Line-by-Line. This new version has a revised Form 720 Form 720-Quarterly Form 540. Form 540 has been re-organized slightly and is now called Form 720 (Rev. September 2022). Learn more about Form 720 (Rev. September 2022) IRS Form 720 Quarterly Federal Excise Tax Return Line-by-Line Instructions — New! This is a revision of the IRS Form 720 Quarterly Federal Excise Tax Return Line-by-Line. This revised version is also more intuitive and has new columns. Learn more about Form 720 (Rev. September 2022) IRS Form 720(Rev. September 2018) Oct 2, 2018: In June 2018, the IRS issued a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 14, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 17, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 22, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 24, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 26, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out. IRS Form 720, Quarterly Federal Excise Tax Return — New! Sep 28, 2018: In June 2018, the IRS released a new version of Form 720. The 2025 Form 720 (Rev. September 2022) is on its way out.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 720, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 720 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 720 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 720 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 720 2025