Award-winning PDF software

Irs 750 Form: What You Should Know

Form 709 (with an attached self-certification to the return), which is due March 31, 2021, About Form 8379D, Foreign Tax Credit for Disabled American Veterans — IRS Sep 30, 2025 — Effective for individuals on modified adjusted gross income (MAGI) of 100,000 or less, you can claim the Foreign Tax Credit Form 839-A, Report of Foreign Earned Income on Form 1040 -- Treasury, IRS Apr 1, 2025 — The American Taxpayer Relief Act includes the Foreign Earned Income Exclusion (FEE) for filers who were American citizens or resident aliens at any time that they performed services for a foreign government or a representative of a foreign government, provided that the services were performed while performing services for that government or representative, unless the service performed by that individual was under a contract of employment Form 833, Foreign Income and Assets Tax Return with Estimated Tax Liability — IRS Apr 15, 2025 — You can claim the FEE by entering your foreign earned income and property owned on Form 101 or Form 1040, U.S. Individual Income Tax Return, and attaching Form 833, which is due May 1, 2021, Form 833A, Foreign Tax Credit Withholding Assessment for Disabled American Veterans — IRS Oct 15, 2025 — The American Taxpayer Relief Act provides an exemption from the Form 833-EZ and Form 8938-EZ withholding requirements of the FEE exclusion for service performed by certain American veterans. These individuals must complete all the activities listed in sections A (1).1.a. and A (1).2.a. to qualify for the exemptions but do not take the tax credit for the FEE exclusion. It also provides an exemption from the Form 833-EZ and Form 8938-EZ withholding requirements of certain FEE expenses related to the American veteran's active or inactive status. OCC Code 623.11, “Disability Income” — IRS. Mar 22, 2025 — Effective for individuals on modified adjusted gross income (MAGI) of 100,000 or less, you can claim the Foreign Tax Credit by entering your disability income on Form 1040, U.S. Individual Income Tax Return, and attaching this form to the tax return. Form 844, U.S. Employment Tax Return, or Form 844-EZ, Employment Tax Return for U.S.

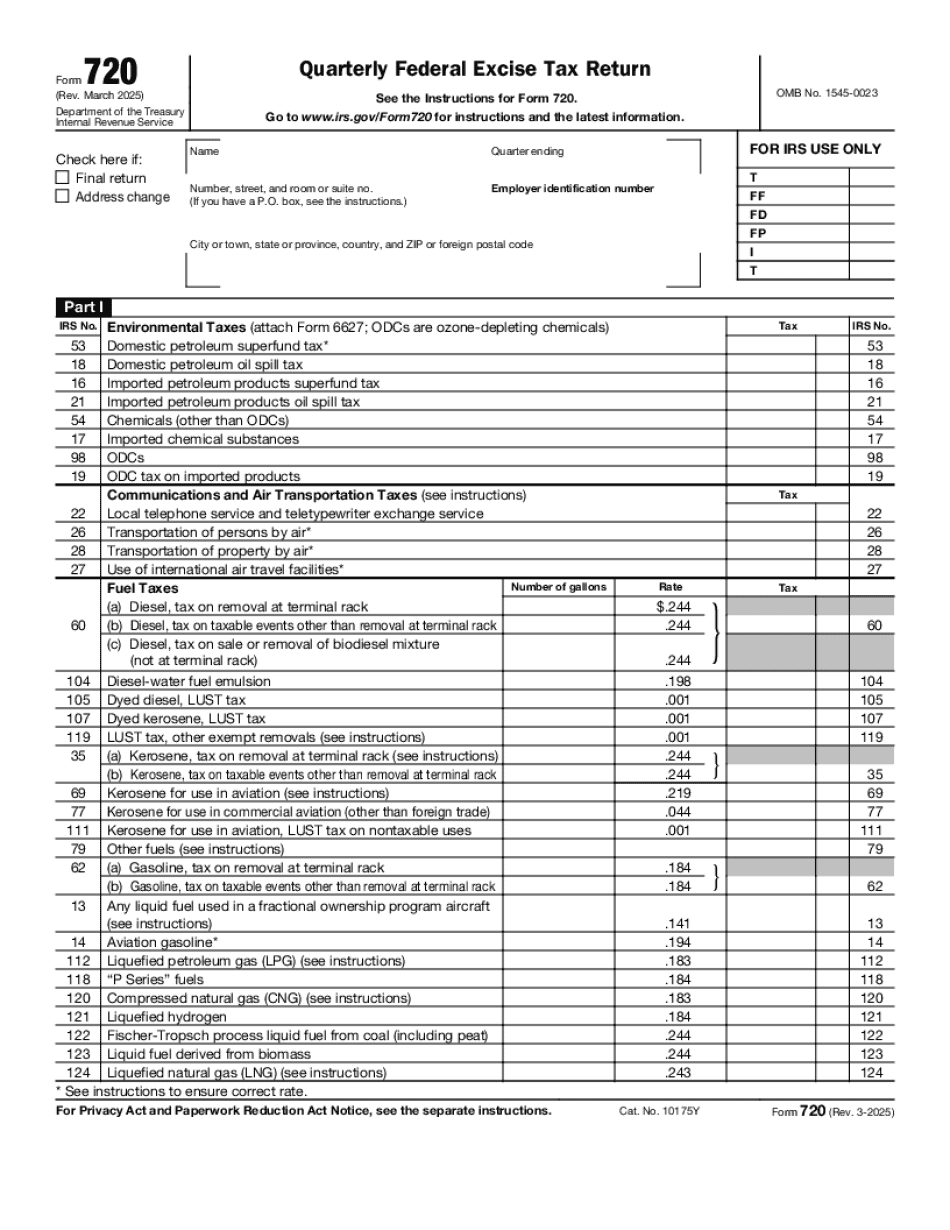

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 720, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 720 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 720 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 720 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.