Award-winning PDF software

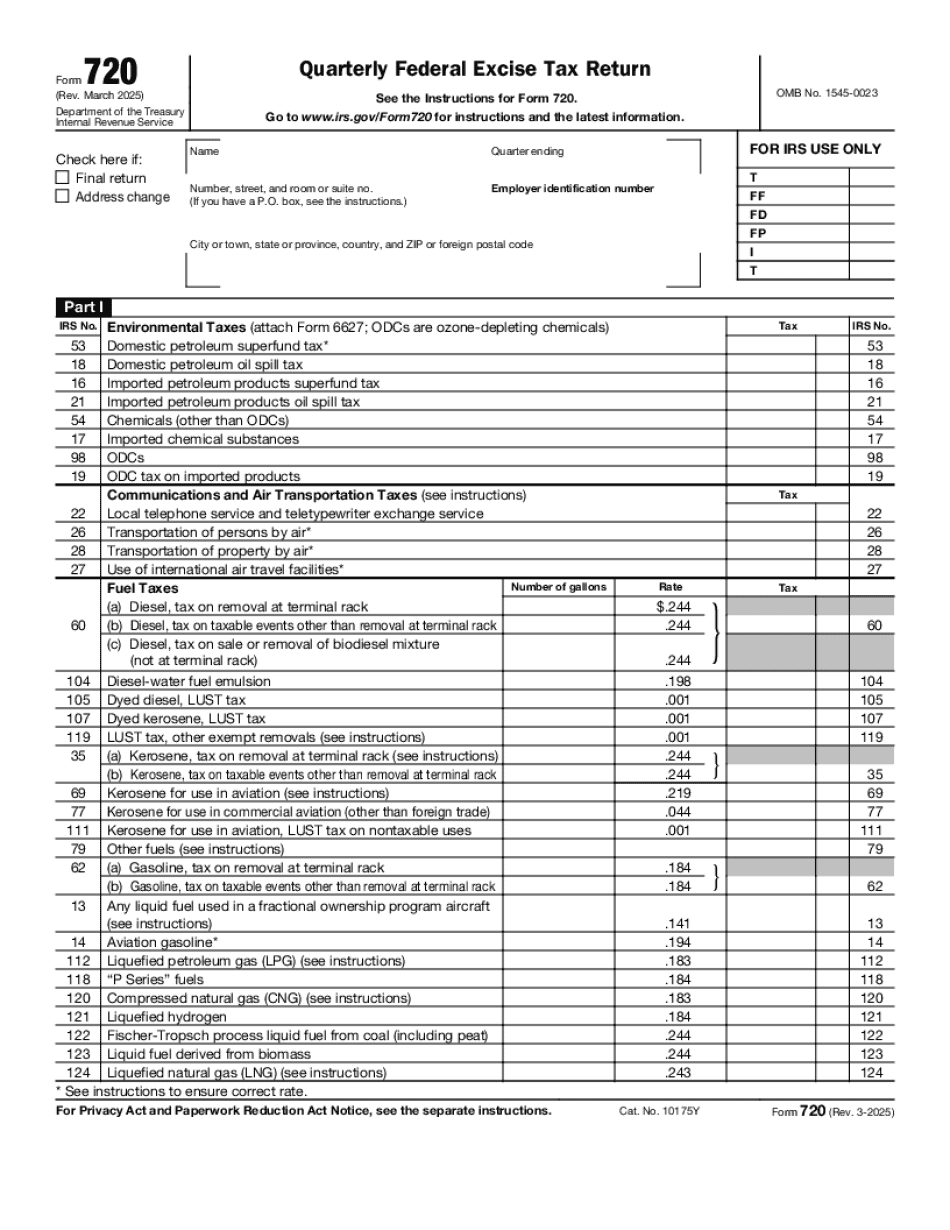

What Is Irs Form 720? Calculate, Pay Excise Tax - Nerdwallet: What You Should Know

Government Accountability Office (GAO). An overview of form 720 is found here — . Why You Should File Quarterly Federal Excise Tax Return With the IRS | Tax Help Mar 28, 2025 — If you own a business that has goods and services subject to federal excise tax, you may file a quarterly federal excise tax return to report the tax to the Government Accountability Office (GAO). Why You Should File Quarterly Federal Excise Tax Return with the IRS — Tax Help Feb 5, 2025 — You may file a quarterly federal excise tax report with the IRS to report the excise tax to the GAO on a Form 720. What Is Quarterly Federal Excise Tax Return? — TaxHelp.com When should you file Form 720 for quarterly excise taxes? | Tax Help Jan 17, 2025 — It's important to file form 720 for quarterly federal excise tax reports because of reporting requirements for excise taxes on goods and services. The most common form is form 720. For more information, see Quarterly Federal Excise Tax Return. The Monthly Federal Excise Tax Report | Federal Excise Tax Center Jan 18, 2025 — If you have more than one business that is subject to federal excise tax, you must file a form 720 quarterly to report the excise taxes to the IRS. What is the quarterly Federal Excise Tax Return? | Federal Excise Tax Center Jan 22, 2025 — If you operate more than one business and deal with goods or services subject to federal excise tax, you must file a form 720 quarterly to report the tax to the IRS. Why You're Required To File Quarterly Federal Excise Tax Return With the IRS | Federal Excise Tax Center Jan 25, 2025 — You are required to file quarterly federal excise tax reports because your business deals with goods or services subject to tax. The federal tax return must be filed as soon as possible after the end of your quarter. Should I File a Quarterly Federal Excise Tax Return on my Business? — Federal Excise Tax Center Feb 12, 2025 — It's important to file quarterly federal excise tax reports because of reporting requirements for excise taxes on goods and services. The most common form is form 720. For more information, see Quarterly Federal Excise Tax Return.

Online solutions assist you to to organize your doc management and supercharge the efficiency within your workflow. Observe the quick handbook as a way to finished What Is IRS Form 720? Calculate, Pay Excise Tax - NerdWallet, keep away from faults and furnish it inside of a timely way:

How to complete a What Is IRS Form 720? Calculate, Pay Excise Tax - NerdWallet internet:

- On the web site aided by the variety, click Start off Now and pass on the editor.

- Use the clues to complete the pertinent fields.

- Include your personal details and phone data.

- Make sure that you enter accurate knowledge and numbers in acceptable fields.

- Carefully take a look at the material belonging to the sort in addition as grammar and spelling.

- Refer to assist part for those who have any inquiries or handle our Aid group.

- Put an digital signature in your What Is IRS Form 720? Calculate, Pay Excise Tax - NerdWallet along with the guidance of Indication Device.

- Once the shape is finished, push Finished.

- Distribute the prepared kind via electronic mail or fax, print it out or conserve on your gadget.

PDF editor will allow you to make improvements for your What Is IRS Form 720? Calculate, Pay Excise Tax - NerdWallet from any online world related equipment, customize it based on your preferences, sign it electronically and distribute in numerous strategies.