Award-winning PDF software

Federal Excise Taxes And Irs Form 720 - Greenback Expat Tax: What You Should Know

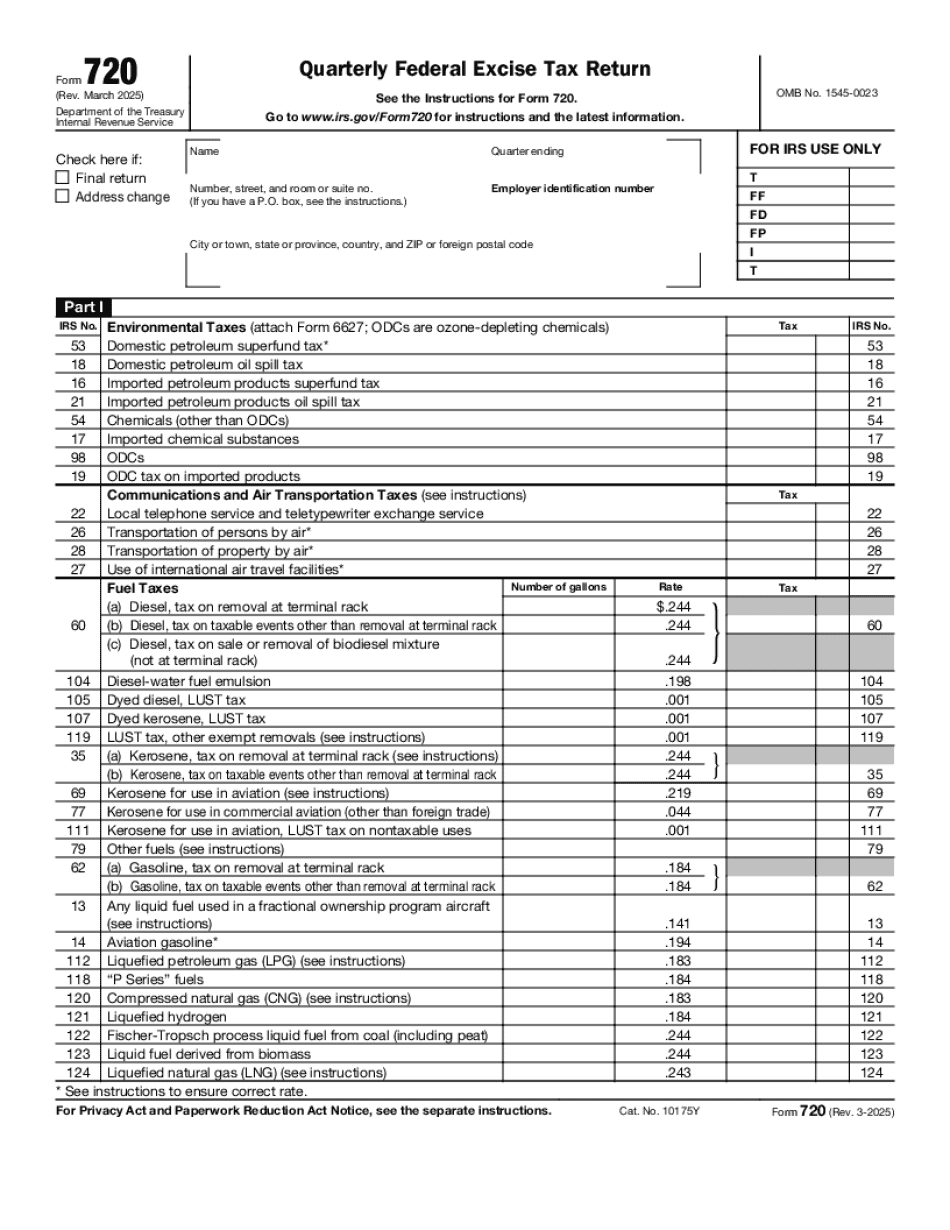

Form 720 (Rev. September 2022) — IRC Sep 30, 2025 — You must use Form 720-V if you're reporting a payment of excise taxes. Form 720-V (Sept. 30, 2022) — Income Tax Return. We will use Form 720(Rev. September 2022) to report the excise tax on a Sep 28, 2025 — Use Form 720 if you're depositing a check. The check is not required to be cash. It would be acceptable to use Form 720(Rev. September 2022), or any other form, if it allows cash payments with no tax. Form 720 (Sept. 28, 2022) — IRS Mar 24, 2025 — Form 720 would be used for the first time if you deposit a check with Form 720(Rev. September 2022) with an account number. Form 720 (May 24, 2022) — IRS Aug 21, 2025 — Form 720 would be used in the year 2025 if you make a direct deposit of a payment. Form 720 (Sep. 21, 2025) — IR-2025 — Form 720 would be needed for the first time Oct 3, 2025 — Form 720 would be needed in the year 2025 if you make a direct deposit. Form 720 (Oct. 3, 2026) — IR-2026 — Form 720 would be needed for the first time when you remit payment of excise taxes. Nov 29, 2025 — Use Form 720 to remit excise taxes from your payment of employment taxes to the IRS. Your payment of excise taxes is not included in your employment taxes when you complete Forms 710 or 711, Wage and Tax Statement. The quarterly payment would be on Form 720 (Rev. September 2022) instead of Form 720. You also would use Form 720(Rev. September 2022) to pay the monthly excise tax. You use Form 720(Rev. September 2022) to report the excise tax, excise tax (for exceptions), and Social Security tax. Use Form 720(Rev. September 2022) to report the excise tax, excise tax (for exceptions), and Social Security tax. Sep 14, 2025 — Use Form 720 when you deposit an amount to avoid filing penalties (with Form 720 and IRS Form 2053).

Online remedies help you to to prepare your document administration and boost the productivity within your workflow. Comply with the short manual for you to carry out Federal Excise Taxes and IRS Form 720 - Greenback Expat Tax, keep clear of problems and furnish it in a very timely fashion:

How to finish a Federal Excise Taxes and IRS Form 720 - Greenback Expat Tax on the internet:

- On the website with all the variety, click Start Now and pass into the editor.

- Use the clues to fill out the appropriate fields.

- Include your own knowledge and contact data.

- Make certainly that you just enter correct facts and quantities in applicable fields.

- Carefully take a look at the articles of your type as well as grammar and spelling.

- Refer that will help portion when you have any issues or handle our Support group.

- Put an electronic signature on your Federal Excise Taxes and IRS Form 720 - Greenback Expat Tax along with the support of Sign Instrument.

- Once the form is concluded, push Done.

- Distribute the completely ready variety through e mail or fax, print it out or help you save on your system.

PDF editor will allow you to definitely make adjustments towards your Federal Excise Taxes and IRS Form 720 - Greenback Expat Tax from any net connected equipment, customize it according to your preferences, indicator it electronically and distribute in numerous options.