Award-winning PDF software

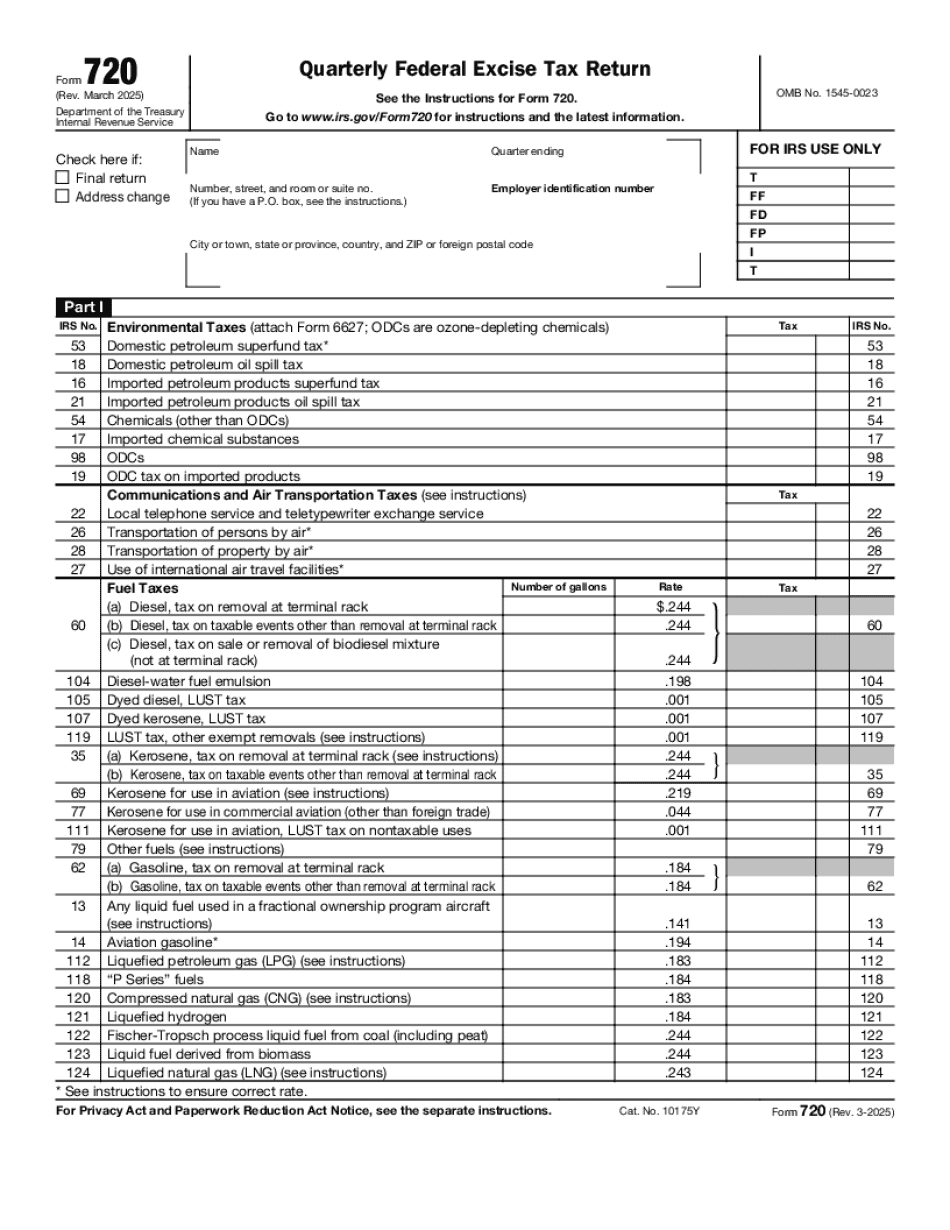

form 720 (rev. march ) - internal revenue service

You can submit the following to your local county tax office : You can use form 720-V to make your federal tax payment if you cannot print or complete a paper form. You do not need to provide an itemized list of items to pay. Payment for a federal tax return can be made by money order, checks, or debit or credit cards using the Voucher Form 720-V. If you have any questions, contact us here. Once your federal tax return is processed, your payment will be sent to us by federal tax officials. It will arrive by mail to us within 6-10 working days.

About form 720, quarterly federal excise tax return - internal

The tax-explanation section explains how Form 720 works and why it is more complicated than Form 8829. The IRS also recommends that taxpayers use Form 720 to calculate their tax liability. The IRS uses this form to determine tax liability when a claim is filed by an employee. Form 720 is used in calculating tax by an employee, spouse, spouse's dependent, and employer. Form 720 is also used by taxpayers for tax purposes for their employees, spouses, and dependents. Form 720 shows up as a line item on a taxpayer's federal income tax return to figure the employer's tax liability on Form 4039. The Form 720 also calculates an employee's tax liability on Form 4040. In other words, Form 720 reduces employer and employee taxes. If a claim cannot be paid with Form 720, the taxpayer should file his or her tax return and request a Form 4029 or Form 710. Form 720, which.

What is form 720?

Mar 15, 2022 Your business should report an amount of income or loss on a form T-874, Trade Income. It is only necessary to report the trade income on Form T-874 if the goods and services were shipped from outside the Canadian borders. Apr 30, 2022 Your business should file Form T-973, Trade-in or Gift in Kind Returns.

What is form 720?

For more information please refer to FEDERAL Excise Tax Form 720.

What is form 720?

This page provides — Georgia Sales and Use Tax In-State Rates — actual values, historical data, forecast, chart, statistics, economic calendar and news. Georgia Sales Tax Rate — actual data, historical chart and calendar of releases — was last updated on September 2018.