Award-winning PDF software

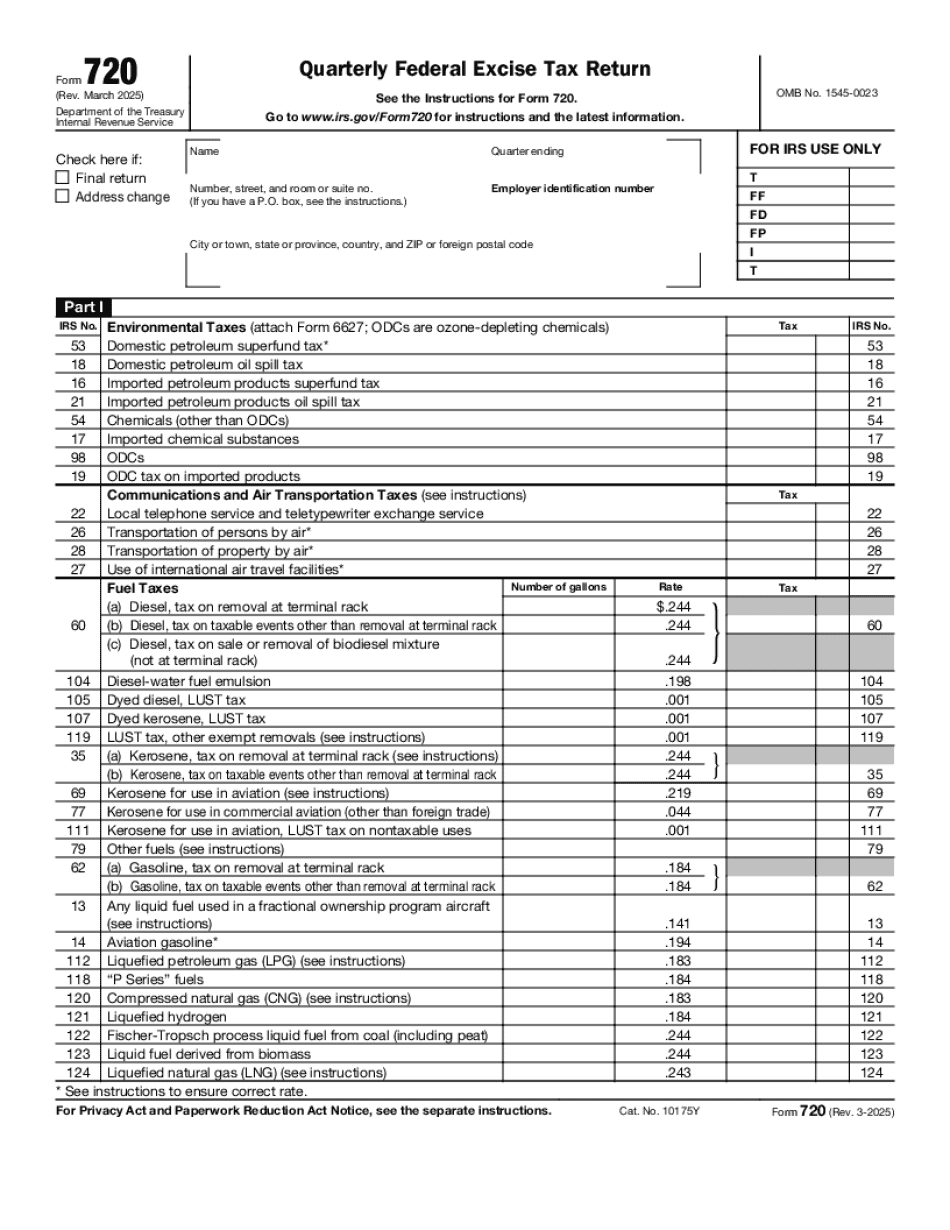

Form 720 for Chico California: What You Should Know

Chico, CA 95948 — Toll Free: This is a nonprofit that provides information services to citizens. This page updated 9/8/2017. The IRS calls the first 500 in taxes you owe to the Government for any one taxpayer, a Federal Excise Tax (FET). But what are the different types of FET's, what do we have to do to pay them, and where can we get help with my FET's? What's the difference between FET's and other sales taxes? Find out on this page. Form 850-M—Sales and Use Tax Return Form 850’M. Sales and Use Tax Return. Tax Rates for Oregon. Sales and use tax (BUT) are sales taxes that are collected from customers to cover the full cost of providing products and services to Oregonians. Each state has different sales taxes. Oregon's tax is the most progressive tax in the U.S. with the lowest percentage at 2.25% (Oregon's rate is slightly lower than the state sales taxes in Kentucky, Montana, Utah, and Washington), followed by Minnesota with a rate of 3.125%, and South Dakota with a rate of 3.0625%. Federal excise tax is imposed on the sale of products and services by Oregon employers and their employees. Oregon is a federal tax jurisdiction, and all taxes must be paid on or before the due date for filing the state income tax return. The Oregon Income Tax form is available at the state department of revenue. Federal Excise Tax Federal excise taxes on products, services and other property are imposed upon the Federal Government by law to fund the general revenue of the United States. These taxes include tax on the sale of: automobiles, parts, and accessories, food, drugs, alcoholic beverages, tobacco products, ammunition, and firearms. States may impose sales and use taxes at a lower rate than the Federal Excise Tax, and some may impose a lower tax on some goods and services than on others. In addition, Oregon charges additional fees and taxes to nonresidents; this is the basis for Oregon tax rates. The federal excise tax rate ranges between .5% and 20% depending upon the product, service, or other property. Oregon also imposes a State tax rate of 5% on federal sales and use taxes, regardless of the rate imposed by the federal government.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 720 for Chico California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 720 for Chico California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 720 for Chico California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 720 for Chico California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.