Award-winning PDF software

Form 720 online Topeka Kansas: What You Should Know

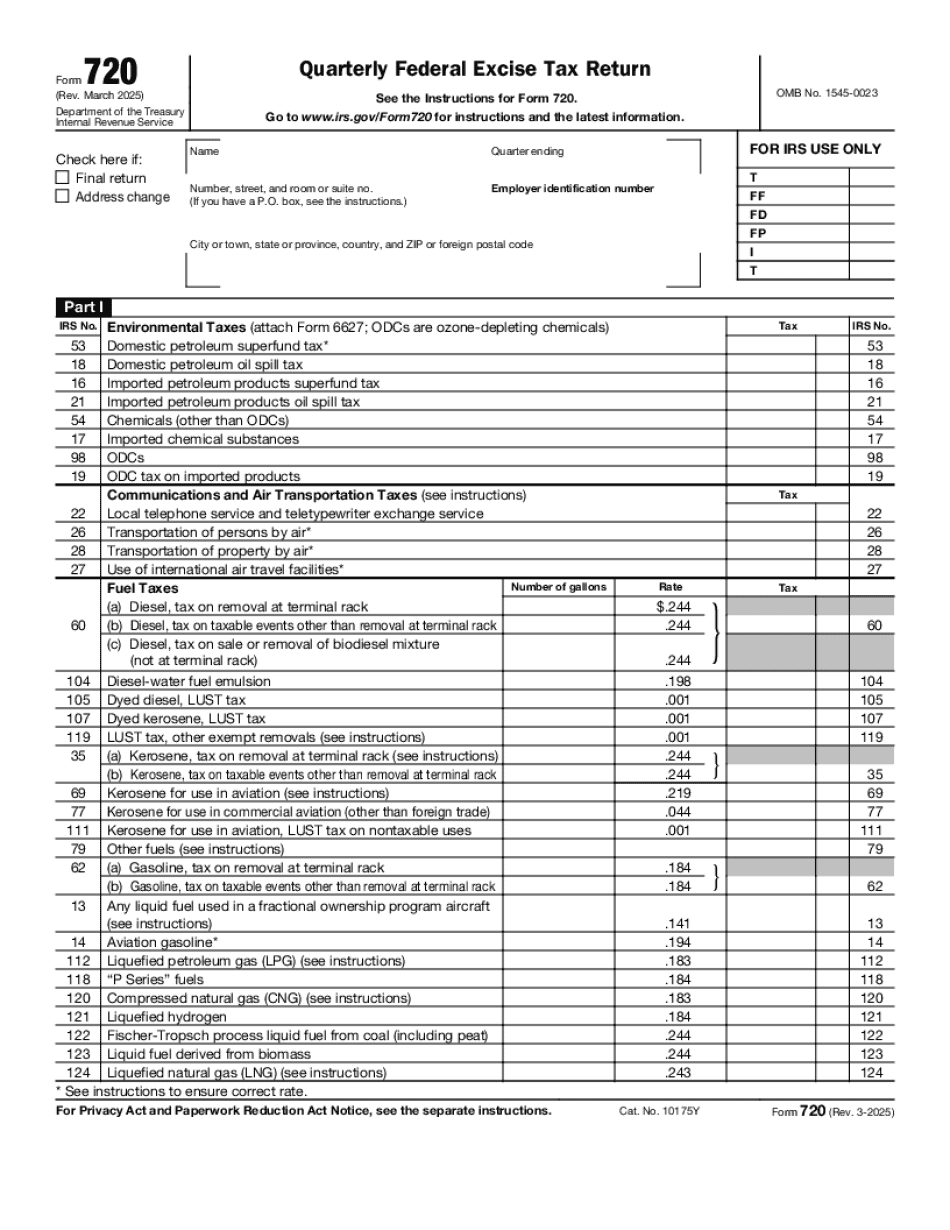

New Forms for July 2025 Update: New forms and forms for July 2025 have been posted! See page 4 for current dates and deadlines. Form 720 (Rev. September 2022) — IRS Form 720 provides the tax collector and the state with information necessary to ensure the timely payment of state tax liability for consumers. The information includes: the taxpayer's tax year; an explanation of the payment methodology; a brief summary of information needed to calculate payment; and, a sample and brief illustration of payment of state excise taxes. The U.S. Department of Labor's Wage and Hour Division has published regulations under Section 552 of Title 29. Section 552 outlines the requirements under which an employer must report and pay the minimum wage and overtime pay to all its employees, whether regular or casual, including employees engaged in certain minimum service operations. Kansas laws: Click here to view Kansas law. How to Pay the Federal Minimum Wage on the Tax-Refund Form The federal minimum wage (the first dollar an employee earns when worked at a nonage rate [such as tips and service credits], after subtracting the tips, or if an employer chooses, the excess of the minimum wage over the federal minimum, must be paid to that employee or, if that employee is receiving tips, that wage must be credited to the employers tip pool (to the extent the employer is required to make credit for the tips). However, as a practical matter, federal minimum wage income that does not come from a tip pool will be subject to federal tip credit withholding, which generally means the employee is taxed on it as income. Thus, if the employee elects to pay the federal minimum wage to himself (or herself), and if the employer chooses to withhold the tip credit for that employee, the employee will be taxed on his or her income. For more information, see: Tip Pooling, Payroll Deductions, and the Federal Minimum Wage, and Tipping. Payment Options of Federal & State Taxes Each state must find the best method based on the tax rate applied to an individual taxpayer in each jurisdiction, the state of residence of the taxpayer, and the type of income in the taxpayer's tax returns and other documents filed. In Kansas, both the federal and state income tax rates are 6.2%. However, Kansas rates will vary more with each increase to the tax rate for high income, and the rate for low income is generally lower than the Kansas state rate.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 720 online Topeka Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 720 online Topeka Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 720 online Topeka Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 720 online Topeka Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.