Award-winning PDF software

Miami Gardens Florida Form 720: What You Should Know

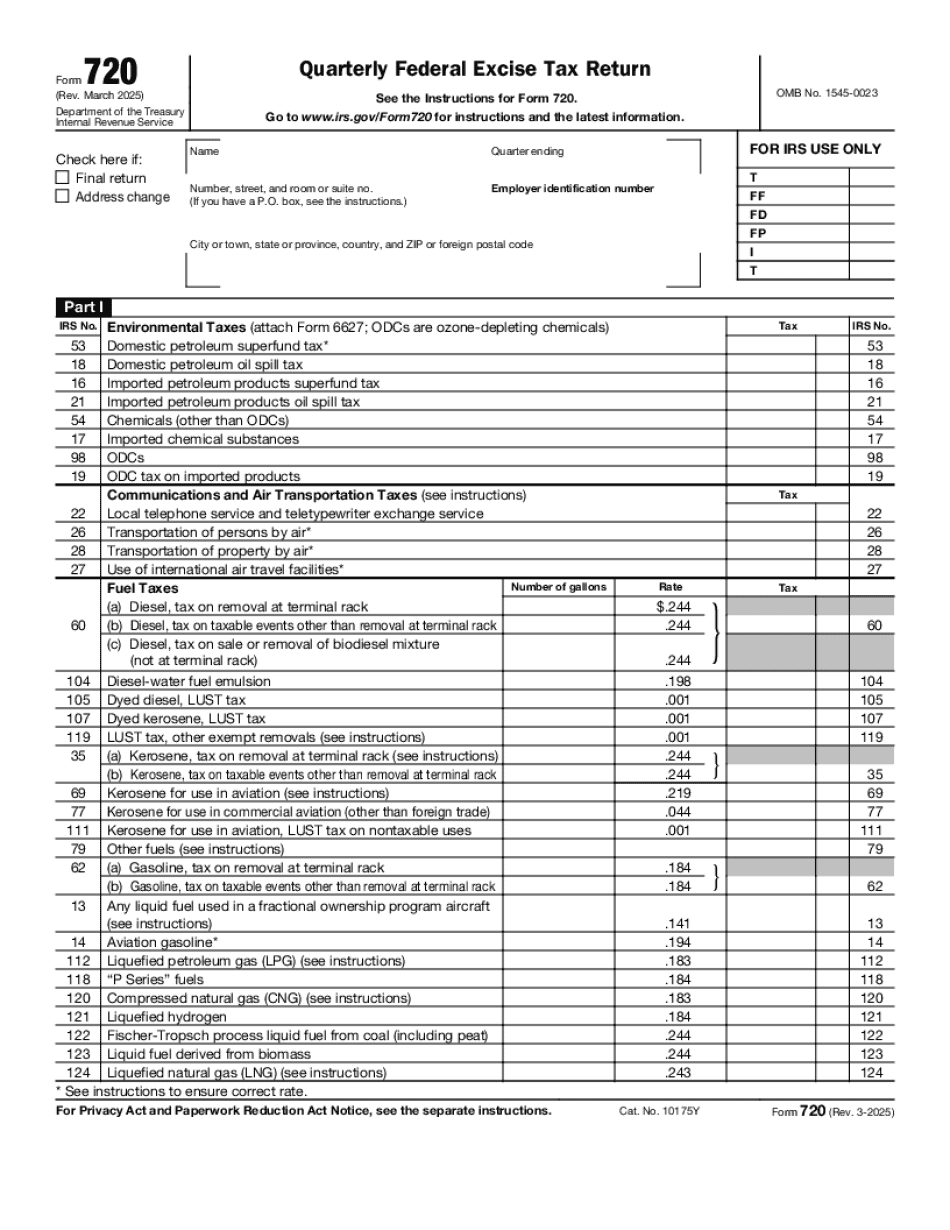

Taxes will be remitted for property taxes, and for all other taxes collected for the City of Miami Gardens, which are a per-resident city of 100,000 or more, and not otherwise subject to state or local assessment. (Form 720: Annual Registration, (Form 720-C: Special Registration).) Tax Exemptions The Federal government has several specific tax-exempt categories: the State of Florida, federal tax-exempt entities, charitable organizations, educational institutions and individuals, and others. Form 720, Quarterly Federal Excise Tax Return A Quarterly Federal Excise Tax Return (Form 720): must be filed and furnished within 12 months of the due date of the return or any extensions granted by Revenue, as indicated on Form 720. To help reduce the potential delay, consider completing Form 720, Quarterly Federal Excise Tax Return (Form 720) in one step by obtaining the form and attaching the necessary attachments with your return. Filing Dates Form 720 and attachments should be mailed to: Office of the City of Miami Gardens Post No. 825-C Attn: Form-720 (Rev. September 2022) 11600 North Federal Highway Suite 1002 Miami Gardens, FL 33313 (The City of Miami Gardens is not responsible for incorrect or inaccurate tax returns filed by the return preparer, the City of Miami Gardens is not responsible for tax filings in other jurisdictions, or for any tax issues that arise through returns that have been filed improperly or inaccurately and should be referred to the IRS for legal assistance.) Form 720 can be completed as one form if you use our online form-making services. This form should be filed either directly by the return preparer or by a personal representative on behalf of the person on whom the return is being prepared. If necessary, Form 720 can be completed and submitted electronically by using a computer or similar device. This includes using the IRS Electronic Filing and Certification Tool (Excel) or the QuickTime/Excel Filing Program (both free.) Tax Exempt status is based on three factors: (1) the taxable activity conducted by the taxpayer; (2) the tax benefit derived; and (3) the value of the property or services acquired by the taxpayer. Taxable Activity: The taxable activity must be for the purpose of earning a profit (gross proceeds of sales other than exempt sales).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami Gardens Florida Form 720, keep away from glitches and furnish it inside a timely method:

How to complete a Miami Gardens Florida Form 720?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami Gardens Florida Form 720 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami Gardens Florida Form 720 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.