Award-winning PDF software

Printable Form 720 Edinburg Texas: What You Should Know

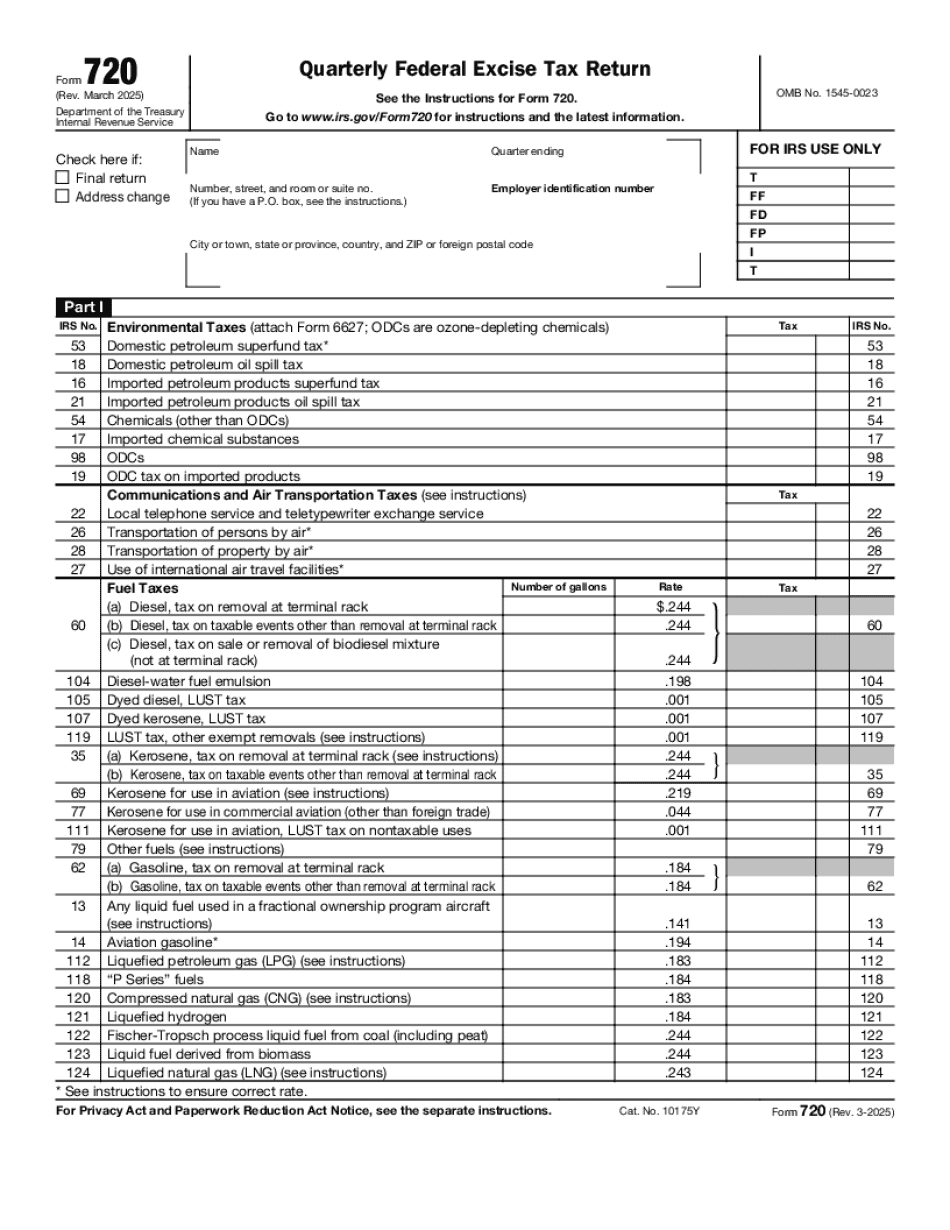

If the seller is an individual, he or she is required to file a federal tax returns and receive refunds annually. If the salesperson is a business, the return is completed based on the information provided. Form 720, the Quarterly Federal Excise Tax Return, provides the seller with the information needed to calculate and pay federal excise tax on the purchase, sale or exchange of property (or services) for personal use (see Publication 505, Sales and Use Tax at for other requirements). Form 720 shows two columns: 1. Amount Due, which is a summary of the tax due from the purchaser or seller. 2. Excess or Additional Amount; which is a total of the tax due to the vendor. In general, the excess or additional amount of the tax due is that portion of the total of the sales price, seller's gross proceeds for the transaction, and seller's expenses exceeding the tax due. The excess or additional amount of the tax due is the difference between the seller's total sales price (including the tax due) on the day of sale, and the tax due. See Pub. 505 for a general explanation of excess tax. If Seller's Total Sales Price Does Not Equal Tax Due, Excess Amount Must Be Payed — IRS The first column shows the taxable amount. The tax is calculated by subtracting the amount due from the tax payable. Amounts due are typically calculated using the formula, sales price × tax due. The second column shows the purchaser's taxable amount. The purchaser will record the amount in the first column in the amount due column of Form 720. The purchaser is required to remit this amount to the IRS by February 15. If the purchaser does not pay, interest is charged at a 10% rate of interest from the due date until paid or the statute of limitations is up. See Pub. 505 for further information. If a business does not sell a qualifying device and the amount due exceeds 600, the excess is due and may be recovered in civil action or as part of the tax. See Tax Relief For Qualified Small Businesses (TSB) — IRS In order to determine the amount of excess, the seller must subtract, on the day of sale, the tax due from the seller's taxable amount. The difference between the total amount due and the amount due plus tax is the excess amount.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 720 Edinburg Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 720 Edinburg Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 720 Edinburg Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 720 Edinburg Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.