Award-winning PDF software

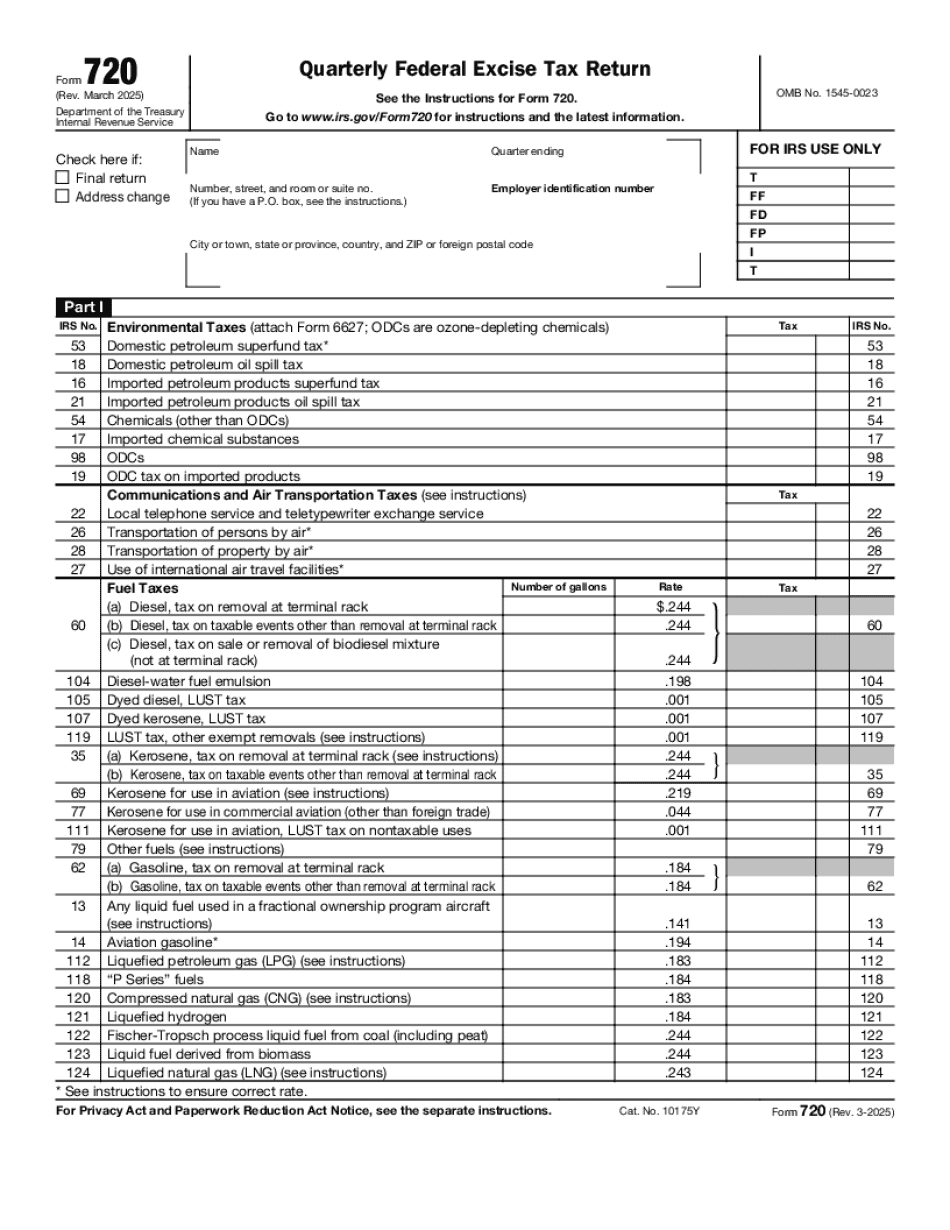

Spokane Valley Washington Form 720: What You Should Know

Relocation) of the Spokane Municipal Code (§24.02.020) except the General Excise Tax (§10.60.020) apply. The General Excise Tax in this section is hereby authorized to fund hotel/motel taxes. B. The tax imposed by this section shall be levied solely for: A. To help fund emergency and other operations for the enforcement of the applicable provisions of chapter 3.20 of the Spokane Municipal Code (§24.02.020) and any regulations adopted under those provisions; B. To be available to local public agencies or units of local government that would be authorized to levy and collect hotel/motel taxes under any legislation that would provide those tax dollars for the payment of essential municipal services; C. To pay for the cost of operations of the hotel/motel tax; or D. To be made available to the Board of Zoning Adjustment for the purposes of making zoning district assignments; and E. To be deposited as provided in subsection (3) of this section subject to the annual appropriation made by this Act. C. The tax rate shall not exceed .025% in amounts derived from the General Excise Tax (§10.60.020) and hotel/motel tax revenue. In addition to all other taxes imposed therein, the board of zoning adjustment shall require at least the following: D. Existing Hotel/Motel operators for which application has been made, or which in the past have applied for a business registration certificate in the manner prescribed by section 22.07 of the Spokane Municipal Code (§§24.20.020 – 24.22.020), and which have not been deemed nonconformable to the provisions of Chapter 3.20 (Relocation), and for which an application has been received and accepted for review and consideration by the Board in accordance with section 22.09 of the Spokane Municipal Code (§§24.20.020 – 24.22.020), shall be subject to the payment of the tax imposed by this section. E. At the time of issuing a certificate of approval to a hotel/motel operator, the business shall designate in writing the amount of hotel/motel tax, the dollar amount of taxes payable under sections 24.02.020 to 24.04.010, 24.04.030, 24.20.090 and 24.21.010 through 24.28.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Spokane Valley Washington Form 720, keep away from glitches and furnish it inside a timely method:

How to complete a Spokane Valley Washington Form 720?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Spokane Valley Washington Form 720 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Spokane Valley Washington Form 720 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.