Award-winning PDF software

Form 720 for Palm Beach Florida: What You Should Know

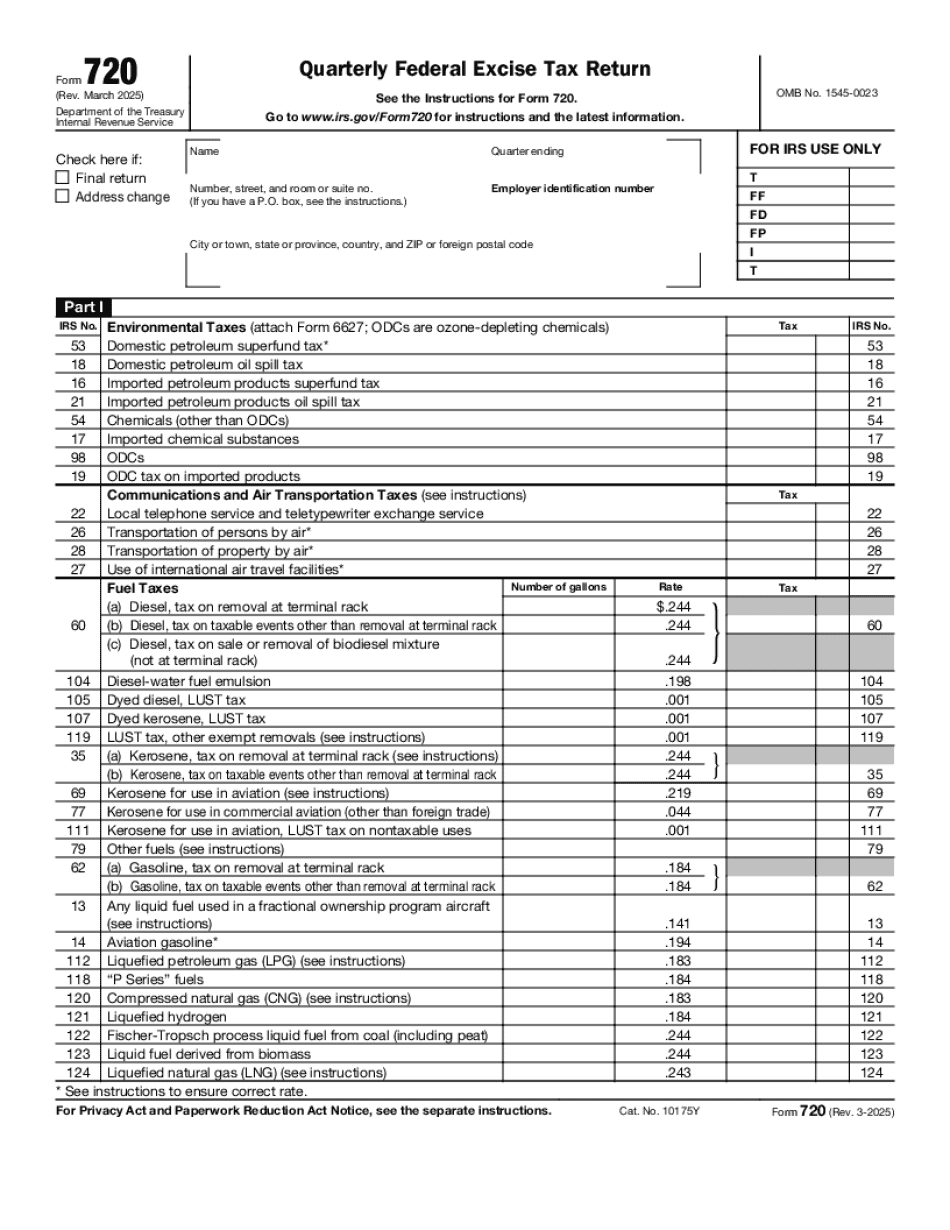

In lieu of payment or signature, the Clerk will provide the. Filing fee of 20, and a Form 720 (Quarterly Federal Excise Tax Return) July 17, 2018: Form 720, Quarterly Federal Excise Tax Return: Revenue and Taxation Bulletin: No. 18-0020. Filing Requirements for Tanning Services. The Clerk of the Circuit Court is the only agent for each taxpayer and is the required to accept and process for filing the quarterly federal excise tax return of a licensed Florida tanning service. In July 2018, Governor Scott repealed the annual tax imposed on the sale of skin cancer products by Florida Tax Commission. Tanning was considered a skin cancer product due to its use of chemicals. Because the state is not paying taxes on this product, any money collected is being directed to the Department of Health, with the Department's intent being to raise funds for skin cancer research. As of 5/31/19, Form 720 (Rev. September 2022) is expected to be available in the mail on or about July 22. That day, the new form will be posted in the Clerk's Office. As a taxpayer, please be on the lookout for Form 720: How to File Excise Taxes. If you still have questions about Form 720 after downloading the Form, please email us. “Quarterly Federal Excise Tax Return” Form 720 In April 2016, the IRS issued a circular to the United States Department of Homeland Security and all agencies and departments of the federal government to assist those agencies and departments in determining whether a federal license or permit was needed to sell cosmetics to consumers in the state of Florida. This was a very confusing document for consumers. The tax in question is a federal excise tax levied on the sale of a regulated product within the state. A federal rule enacted in 2025 requires that Florida taxpayers file Form 720 — a Federal Form to Report and Pay Taxes on Products and Services Taxable Pursuant to Section 6111 of the Internal Revenue Code. In other words, this is the annual check off your credit card is reporting to the IRS. The only difference between an excise tax and a sales tax is that while excise taxes are paid to the US government, sales taxes are paid directly to the state. Since May 2011, Form 720 has been used for both sales and excise taxes, and as of January 2017, federal law changed which now requires all income tax return reporting to be on the form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 720 for Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 720 for Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 720 for Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 720 for Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.