Award-winning PDF software

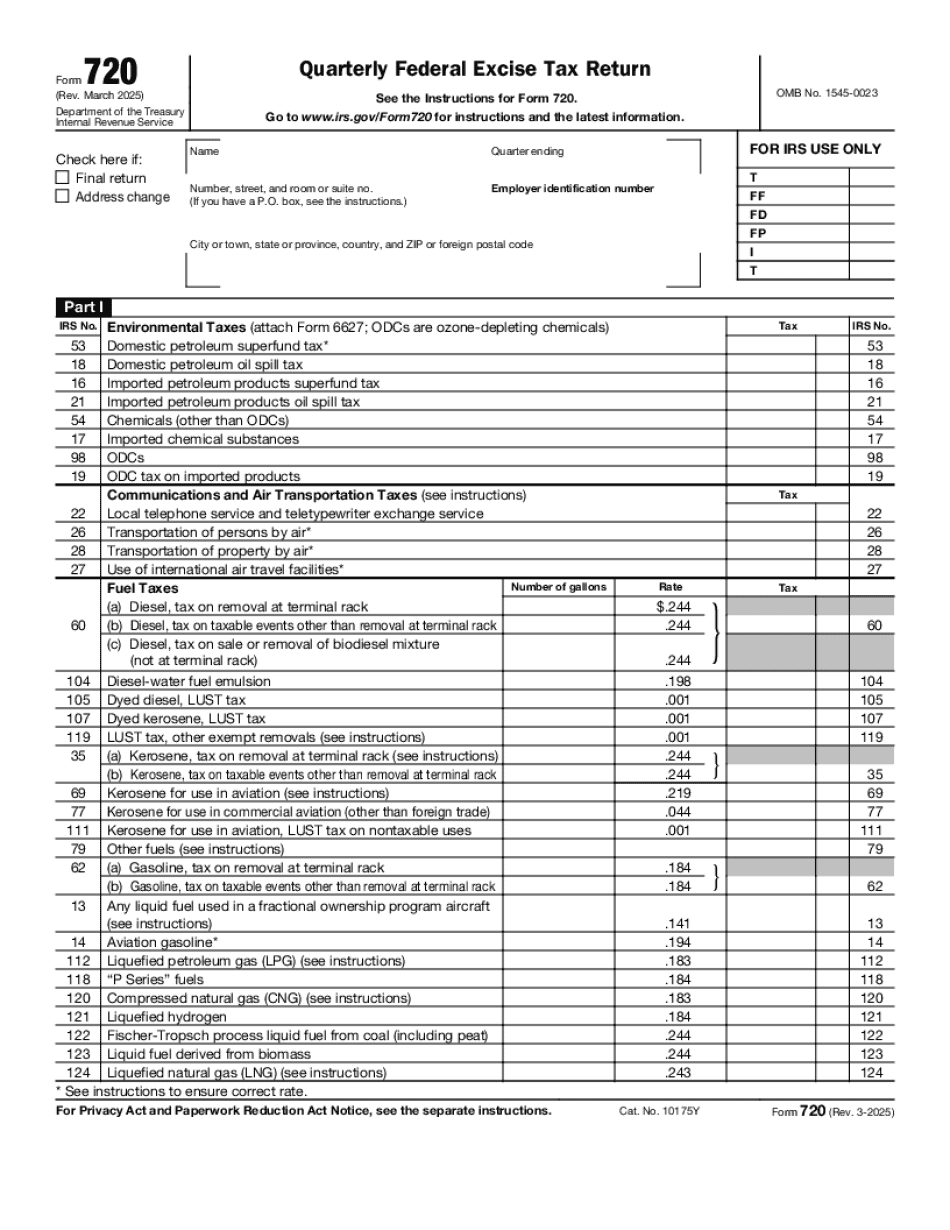

Form 720 online Bexar Texas: What You Should Know

The entrance to this garage is from the West side of S. Alamo St. located at Nieces St. and N. Main St. You may park in the parking lot in the parking structure adjacent to the West side of S. Alamo St. Parking rates include both hourly and daily parking. Our downtown offices are located at the corner of S. Alamo St. and Nieces St., which is directly across from the San Felipe Street Bridge. Directions to the San Felipe Street Bridge: Turn left on the San Felipe Street Bridge over the San Antonio River and continue for about three blocks. If you cross the San Antonio River, you will cross a small bridge, the Bexar County Parking Garage. What do I do with my BIR tax return? BIR returns are filed with the County when completed by the County. The return must be filed with the Bexar County Recorder's Office, along with a payment of your County fee. The Bexar County Recorder's Office will mail you a return to your designated address. The return must be completed and signed by the taxpayer. It must be dated prior to the taxpayer having lived in Bexar County for 12 months and with the correct taxpayer identification. There must be a check or money order made out to The County, not to yourself. The return must be mailed via regular American Mail postage or certified mail addressed to: The County Recorder's Office. 1204 Congress Ave. San Antonio, TX 78210 You can download and submit an e-file return here. More than 100 tax filers use this convenient online process to pay their taxes electronically. If you are paying a tax to the City of Bexar, please see our San Antonio City Guide. Where can I go to get my Texas Property Tax Invoice? To pay property taxes from the State of Texas to the City of Bexar or from the City of Bexar to the State of Texas, you will receive and print out a Property Tax Invoice to make payments online and for other services at. You can also pay online from any other state by checking the Texas link above. Where do I mail my Property Tax Invoice or Tax Return to? Property tax returns must be mailed to: The Bexar County Recorder's Office 1204 Congress Ave.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 720 online Bexar Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 720 online Bexar Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 720 online Bexar Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 720 online Bexar Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.