Award-winning PDF software

Massachusetts Form 720: What You Should Know

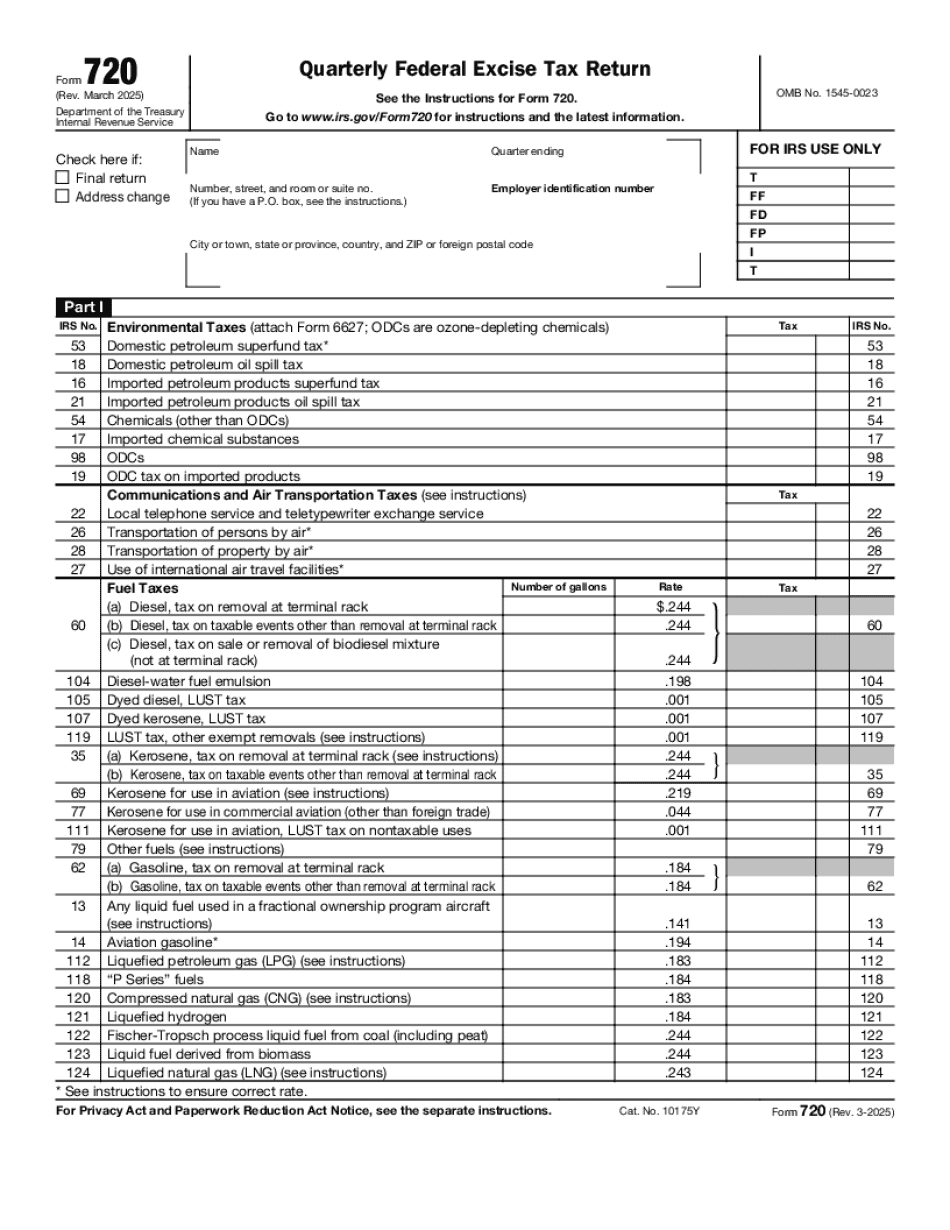

Generally, this tax does not apply to amounts received for, or in the course of, a trade or business. For more information, see IRM 21.5.4, General Information on Imposition of Corporate Income Tax. Form 720 is available in English, Spanish, French, and Korean. Get copies of these forms. You can call or visit e3net for a FREE copy. If you need more than one copy, please see the following link for more information about getting copies of Form 720. Form 720(A) is used by the Secretary of the Treasury to provide notice to taxpayers of impending action by the Secretary to assess and collect excise taxes arising from their failure to report certain sales or use items. Form 720(B) is used by the Secretary of the Treasury to provide notice to taxpayers of impending action by the Secretary to tax certain income of employees (such as wages, salaries, tips, and commissions) of a person who engages in a trade or business (but, as mentioned earlier, does not include a sole proprietorship). Form 720(C) is used by the Secretary of the Treasury to provide notice to taxpayers of impending action by the Secretary to tax property of a nonresident alien resident and of certain other income of such nonresident alien. Form 720(D) is used by the Secretary of the Treasury to provide notice to taxpayers of impending action by the Secretary imposing an excise tax on the sale or exchange of inventory and certain other income related to inventory. The taxpayer can claim an excise tax credit through EFC or EFC-E. Form 720(E) is used by the Secretary of the Treasury to provide notice to taxpayers of impending action by the Secretary to tax payments to third parties in which the third party was not physically present at the time of the sale or exchange. Under the excise tax rules, if the taxpayer's payment is a gift, then the tax is based on a percentage of the value of the gift, equal to the difference between the fair market value of the gift and the amount includible in gross income by the gift. IRM 21.5.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Massachusetts Form 720, keep away from glitches and furnish it inside a timely method:

How to complete a Massachusetts Form 720?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Massachusetts Form 720 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Massachusetts Form 720 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.