Award-winning PDF software

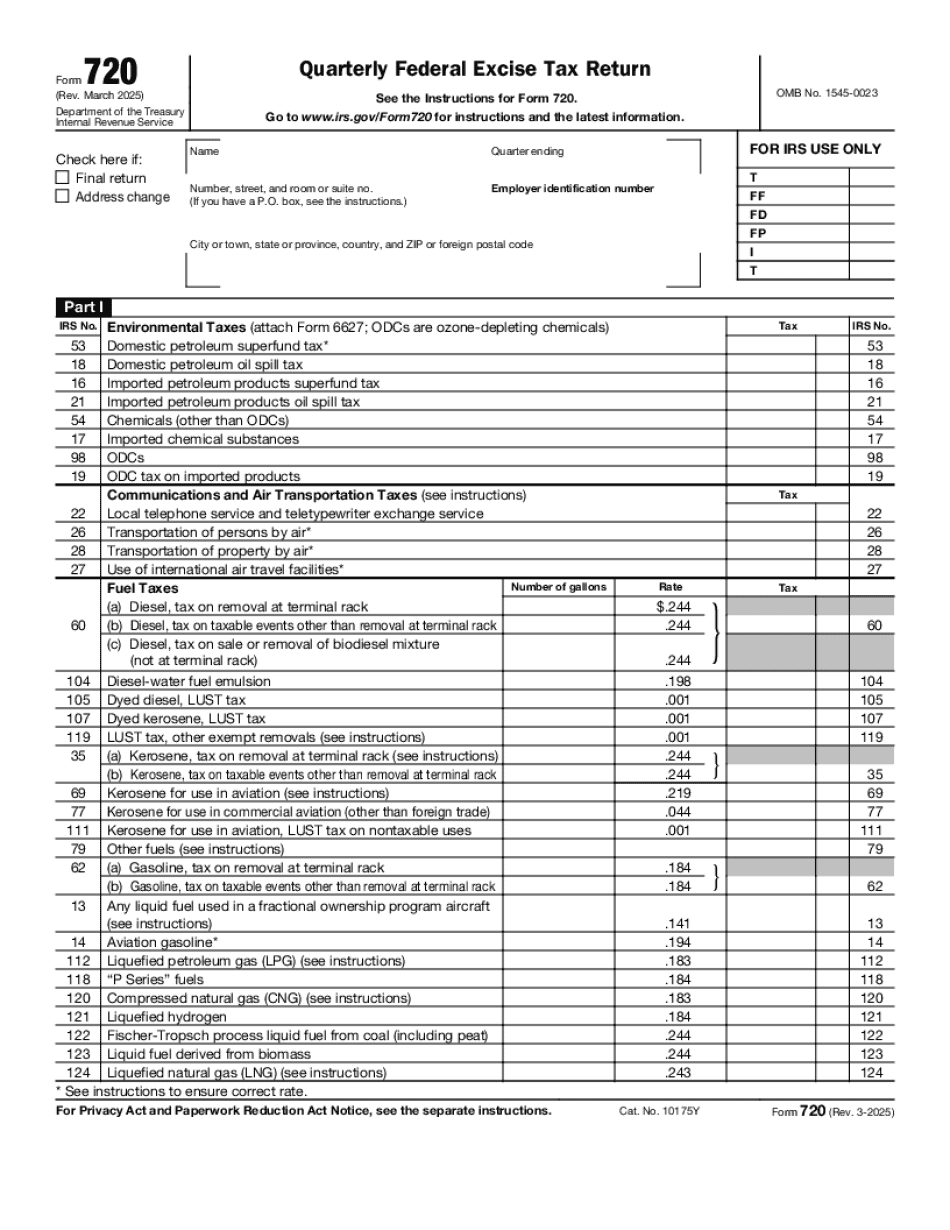

Printable Form 720 Sunnyvale California: What You Should Know

What If I Don't Qualify For Tax Credits? — Turbot Ax Tax Tips and Videos Mar 18, 2025 — I am going to a trade show this weekend, and I have to be away for 4 days. I've started taking courses on tax law. I also intend to attend the CRA exam. Is there any way I can use the Can I Deduct the Sales Tax I Pay on New Computer/Consoles/TVs? — Turbo Tax Tax Tips and Videos Mar 23, 2025 — Are you getting a new computer or a new cell phone? If you haven't already, get a tax-deductible donation. The donations will go toward the new gadgets and tax-deduction What if I Don't Qualify for Tax Credits? — Turbot Ax Tax Tips and Videos Mar 30, 2025 — If you have never filed a federal tax return, you aren't eligible for the Earned Income Tax Credit. The credit is the tax breaks provided by the IRS specifically for those who earn little to no money and don't pay taxes on their Form 706: Federal Tax Credit Return — TurboT ax Mar 31, 2025 — The first form used for the Federal Tax Credit is Form 706. Form 706 is used to calculate the tax credit if you are a filer and a recipient of a qualifying Form SSA: Federal Return — TurboT ax Mar 31, 2025 — Form SSA is your tax return when it is filed. If you don't provide any income or assets (such as property, stocks, bonds, etc.) the IRS simply won't file a tax Form 886D: Report of Foreign Bank and Financial Accounts — TurboT ax Apr 7, 2025 — A foreign financial account is any account held with a foreign financial institution (TDI). The term “domestic” is defined by the IRS for the purpose of the Foreign Account Tax Compliance Act (FATWA). A taxpayer holding a foreign financial account is required to withhold U.S. taxes on any income, dividends, or capital gains received, unless the U.S. Form 1040–Line 21: Foreign Tax Credit and Foreign Tax Credits — TurboT ax Apr 7, 2025 — You can claim tax credits for foreign income on Form 1040 line 21. Form 1040 line 21 includes both foreign tax credits and foreign tax deductions. You can claim deductions using the same Form 8802, Foreign Tax Credit Return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 720 Sunnyvale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 720 Sunnyvale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 720 Sunnyvale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 720 Sunnyvale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.