Award-winning PDF software

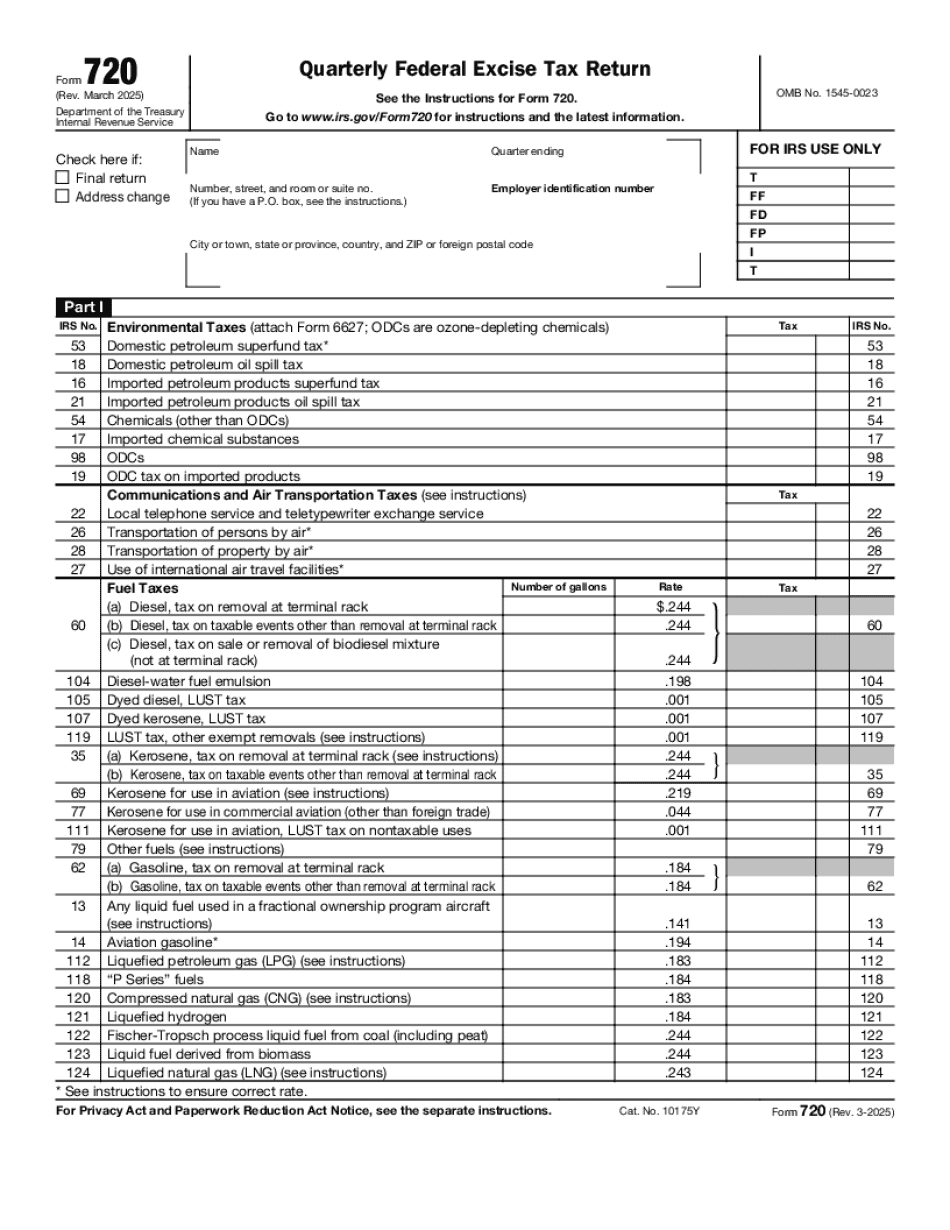

Printable Form 720 San Jose California: What You Should Know

The minimum California state income tax is 1.00% of your California state taxable gross salary if your gross salary does not exceed 150,000 (or 150,000 or more for married couples filing jointly) for the year. Additional Notes: Additional Notes : The amount of your net income may be reduced if you: Maintain an “outside business” for more than half of the year Have an income below the amount of the tax Income from outside employment must be shown as income above 15,000 of your Gross State and Local Area Income California is the only U.S. state (but not the only state in Canada) that does not have a Personal Income tax, a capital gains tax, or a sales tax. California also has no capital gains tax, but this is a sales subject to sales tax only in many areas. Other taxes such as a Sales tax have the same effect as sales taxes in reducing net income. The state also has no personal property tax. As an American corporation that has been incorporated in California, I have to pay US state corporate income tax of California's highest rate of 22.5%. The effective rate for California as a whole is slightly lower, however. For more information about California corporate taxes, be sure to check out the California Department of Corporations and Business Enterprises. Calculating your Tax Liability under California Corporate Income Taxes Calculating your tax liability under California Corporate Income Taxes Calculating your tax liability under California Corporate Income Taxes for single taxpayers If you have no deductions or exemptions for California's Corporate Income taxes, you or your spouse, dependent or other members of your family are liable for California state income tax, even if you receive any personal benefits from the corporation's earnings. The liability is determined based on annual taxes, net income and credits/refunds/adjustments of tax, etc. If you are married and file Joint(e), you may be eligible for credits that reduce or eliminate liability. Your spouse, dependents or others who were also liable for the amount of your tax for the year are assessed the California state income tax liability without any deductions or exemptions for the state corporate income tax. Calculating your Tax Liability based on State Income Taxes Calculating your tax liability based on State Income Taxes for joint(e) taxpayers Calculating your Tax Liability base upon Income Tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 720 San Jose California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 720 San Jose California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 720 San Jose California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 720 San Jose California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.